Create a simple budget with this great guide. You’ll be able to walk through the steps to create your own budget, according to your unique expenses. The idea behind creating a budget is not only to limit your spending, but to see where your money is going.

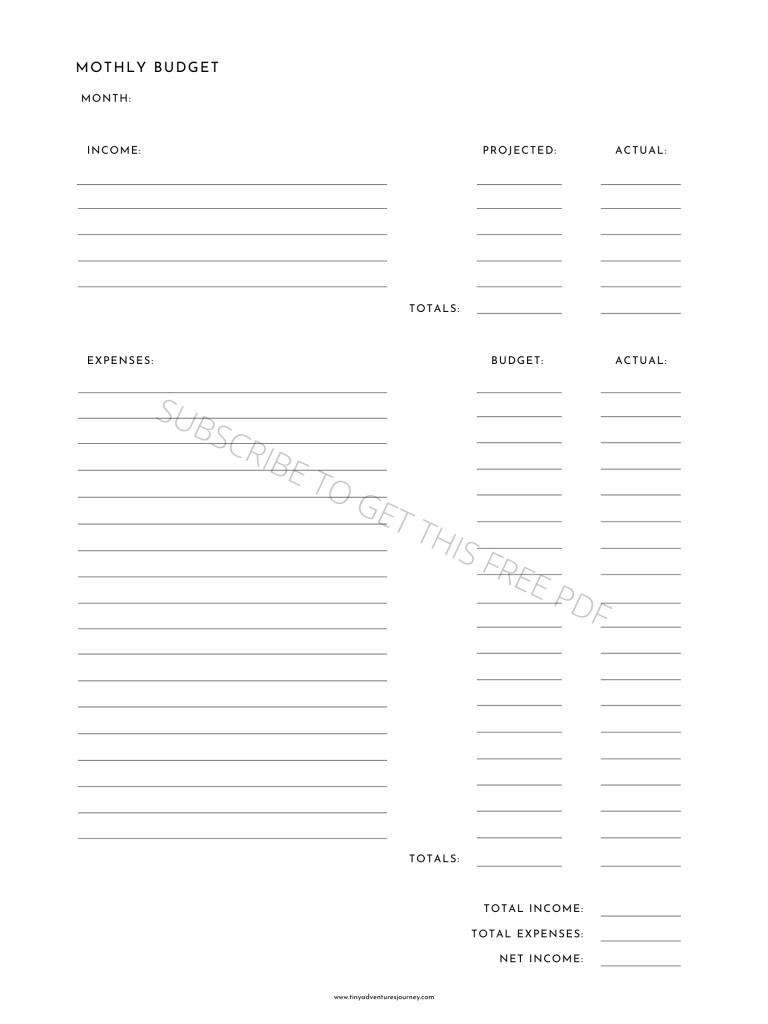

Simple Budget Sheet

The first thing you need to do is to decide how to write out your budget. I highly recommend having a pre-made simple budget sheet. I couldn’t find one that I found fit my own needs so I created my own Simple Budget Sheet.

You can receive this PDF for free by signing up here. (If you’re already signed up, you can still enter your information and receive the free Simple Budget Sheet!)

On this sheet (or the sheet of your choice), make sure to write down all of your expenses. Personally, I like to divide my expenses into the following categories:

- Mortgage

- Electricity

- Home Insurance + Repairs

- Car Insurance + Repairs

- Fuel

- Groceries

- Phone + Internet

- Personal Purchases

- Pets

- Gifts

- Debt Repayment

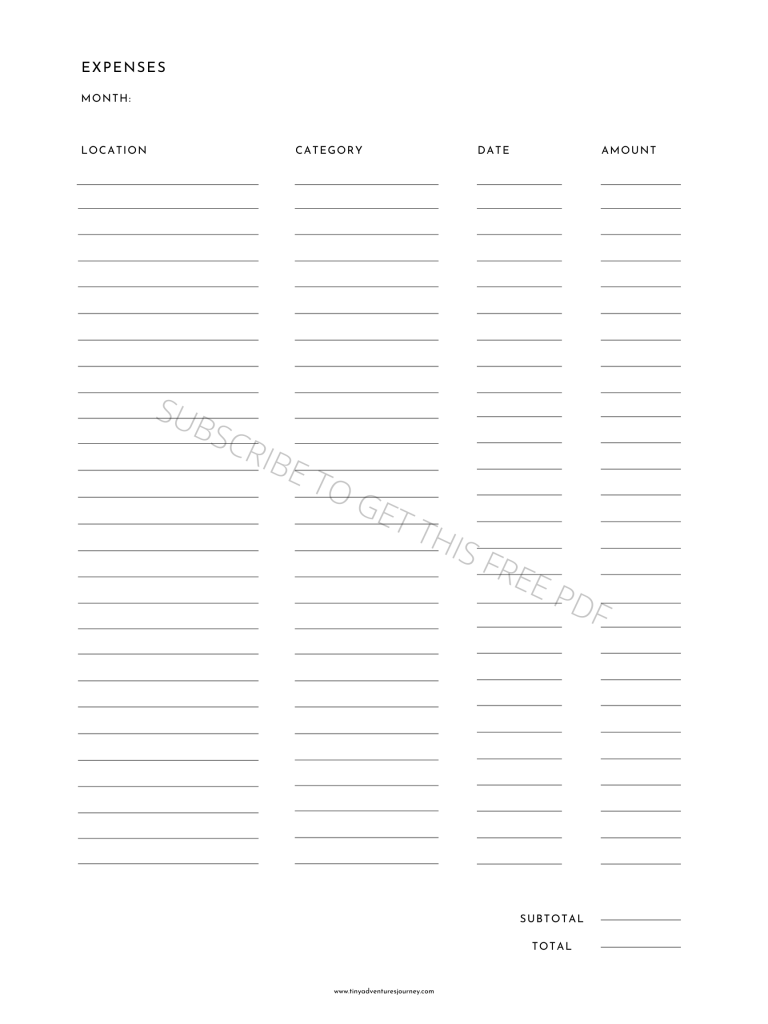

Expenses Sheet

If you’d rather track each of your purchases on a full sheet before calculating your totals for each category, I’ve created another printable sheet just for that. You can sign up here (or use the previous link) to receive this PDF document for free:

The best way to stay on track with your budget is to either fill it in every day, or to fill it in once a week. I prefer to fill it in on a weekly basis, because some days I don’t have any expenses and some days I have 3 or 4 expenses. I’d rather get it all done at the same time. But be warned – it is not advised to wait at the end of the month because it will feel very overwhelming to get through all your expenses.

Reviewing

Once the month is done, look back at how much you spent on each category. What stands out to you? Are you spending too much money on one category? And most importantly, ask yourself, “Am I spending more than I’m making?” If there are any issues that arise – and it’s completely normal to have issues! – you can start working to find a solution.

The next step is to adjust your budget for the following month. You can set smaller limits for certain categories, or adjust amounts if your bills came in higher (or lower) than you thought. I always recommend budgeting more than you expect to pay, so you can be prepared in the event that you get a larger bill one month.

Repeat the process for a second month. See what you’re able to accomplish with your new budget. You might see that trying to reduce an amount just isn’t possible. Try again with new goals, making adjustments to represent what your reality is.

If you want to learn more about how to save money, you might like to read these posts: